Expertise

Praxity’s member firms are able to provide a wide range of high-quality services to their clients.

Praxity’s member firms are able to provide a wide range of high-quality services to their clients.

Praxity Alliance members have specialist skills in nearly 60 separate accountancy and consulting service areas.

By seamlessly sharing international expertise, members and their clients can access unrivalled professional support, helping their clients navigate complex business and tax affairs across borders. Members are free to collaborate and to hand-pick expert advisers from over 500 offices worldwide, forming multi-disciplinary teams to meet every client need – locally, nationally and globally.

Wherever a business is located, whatever sectors it operates in and whenever support is needed, a Praxity Member firm can deliver a fully coordinated cost-effective and competitive service, drawing on the very best mix of regional and technical experts – whatever the assignment requires.

Praxity does not provide client services – all functions are performed by Alliance member firms.

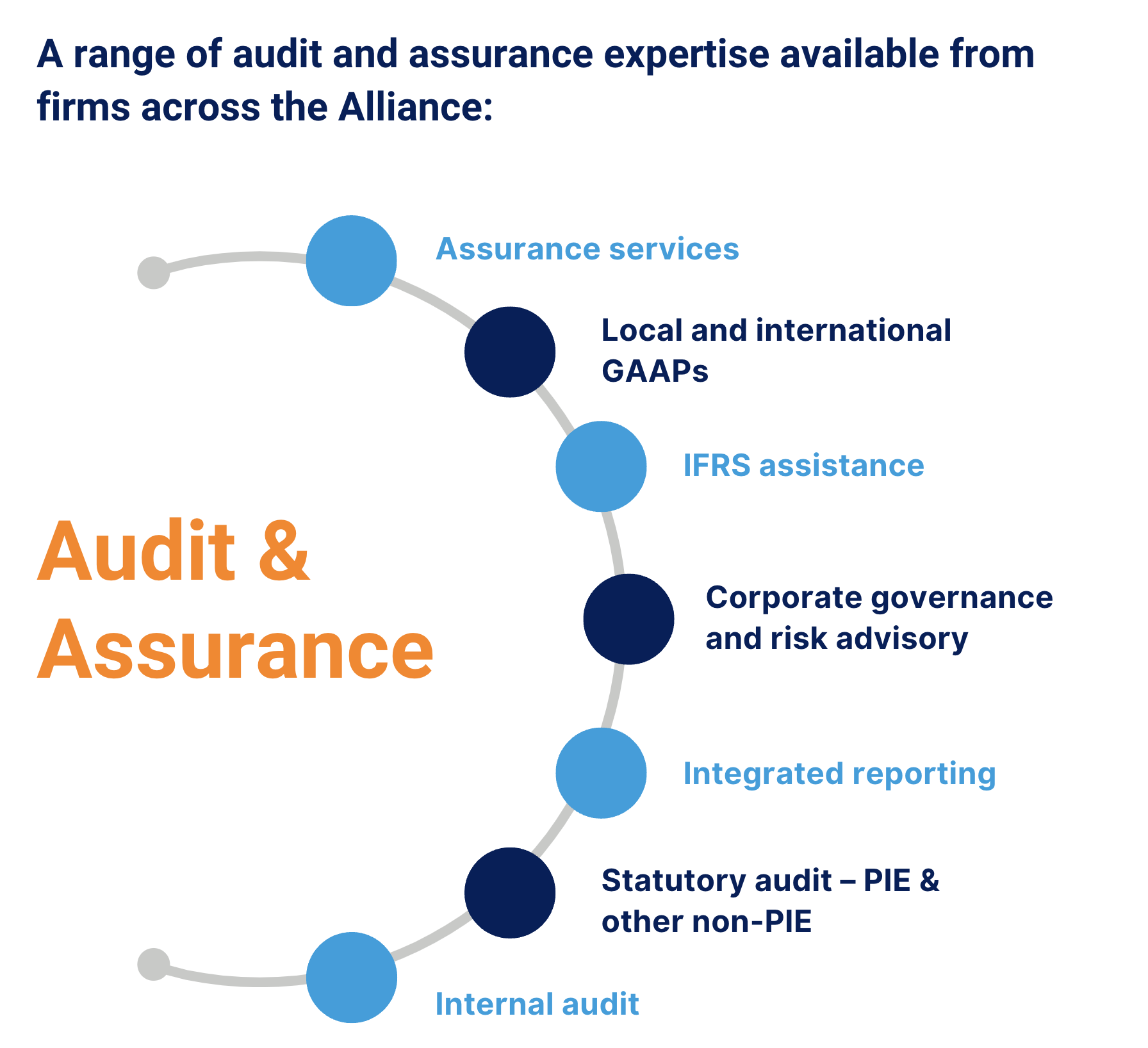

Audit and Assurance

![]()

Statutory audit is a mainstay service of every professional accounting services firm. However, in today’s climate a single local perspective is often not enough, especially for organisations exploring opportunities to grow across borders. Praxity member firms have the experience and expertise to provide assurance to their clients, ensuring that annual audit and financial reporting requirements are compliant and fairly presented in every territory.

Working together where necessary, Praxity members can manage the entire audit process, collaborating with other specialists across the globe.

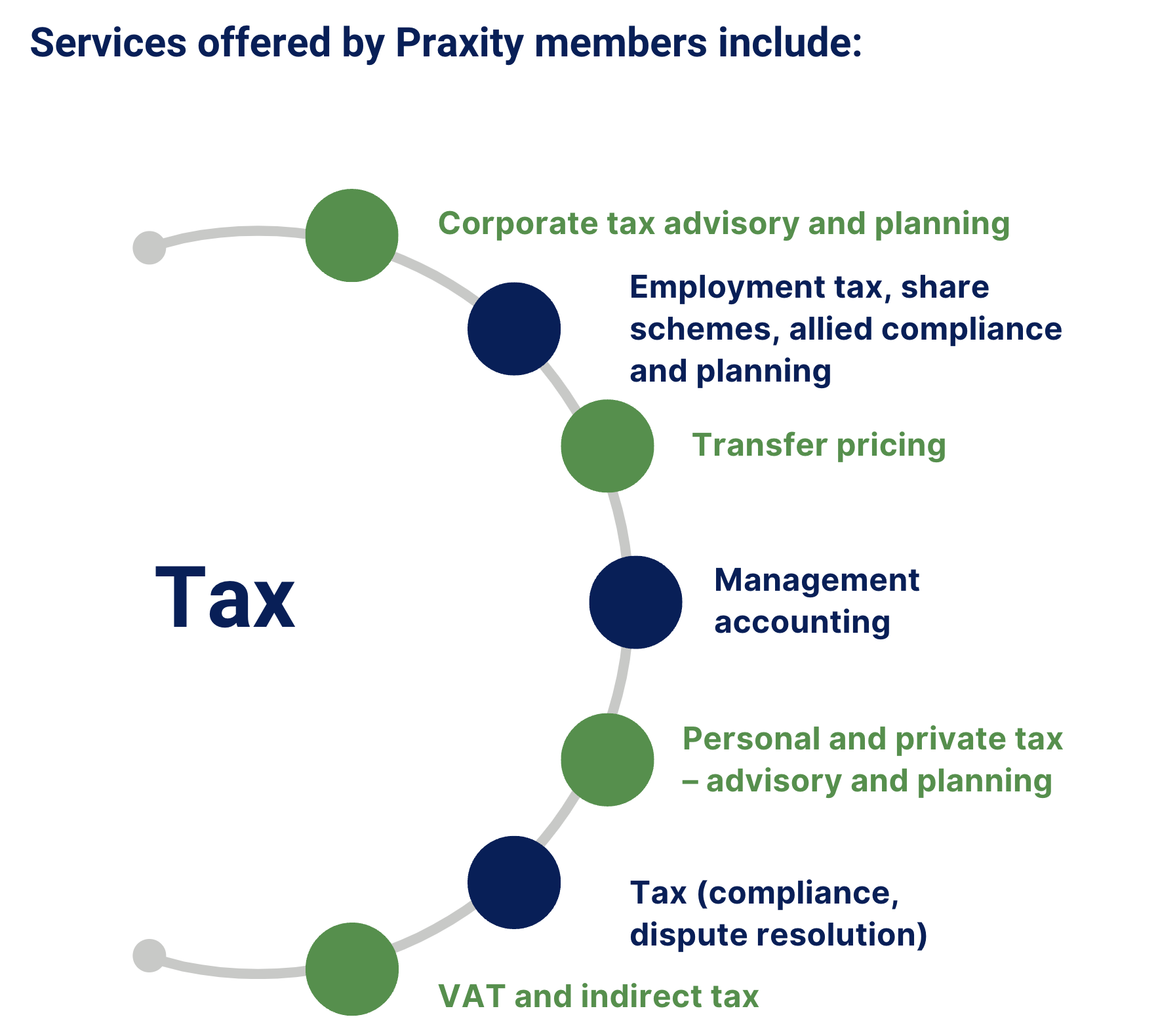

Tax

![]()

The value of service delivery cannot be underestimated. Understanding local, let alone international tax challenges, is never easy. Maintaining profits while responding to regulatory changes and cross-border tax regimes is inherently complex. Praxity member firms can help. Drawing on the expertise of specialists in each key jurisdiction, members offer an holistic approach and can pull in any combination of personal, corporate, sales tax and transfer pricing professionals, as they are needed.

Outsourcing

![]()

The daily pressures that business management teams face are the same worldwide. Praxity Alliance members can help each other alleviate some of these stresses through the core specialist services they provide, meeting business accounting, tax, financial management and consulting needs.

Outsourcing can be the perfect cost-effective solution if you’re looking to grow your business, without taking on new staff permanently. As well as removing the burden of compliance chores, Praxity members can also introduce greater efficiency, cost control and effective management. This leaves you and your business to focus on the important things.

Advisory

![]()

Praxity member firms work with innovative companies around the world, helping them to grow. Specialists can support clients as they explore the available options, providing a full range of lead advisory or transactional services as projects progress. Whatever stage of development a business is in, advisors from firms across the Alliance can help it on itd path to success.

Thanks to Praxity’s global reach, member firms and their clients can access expertise in almost any industry sector. They can start preliminary conversations, liaise with business counterparts and efficiently manage each step of the process.

Of course, not every endeavour can be successful all the time. If business falters, Praxity firms are well placed to mitigate damage to commercial reputation and minimise interruptions to business. Even when the worst seems inevitable, businesses may be rescued and firms in the Alliance share many decades of experience in the field of corporate recovery and insolvency. They can present and clarify the available options, enabling their clients to best meet the needs of their stakeholders.

It is not only businesses that face management and investment decisions - high net-worth individuals face increasingly complex challenges in estate planning and assets. Praxity members can assist with structuring income, finding fiduciary solutions that best meet financial objectives, ensures assets are kept secure and that trusts are managed in line with regulations.

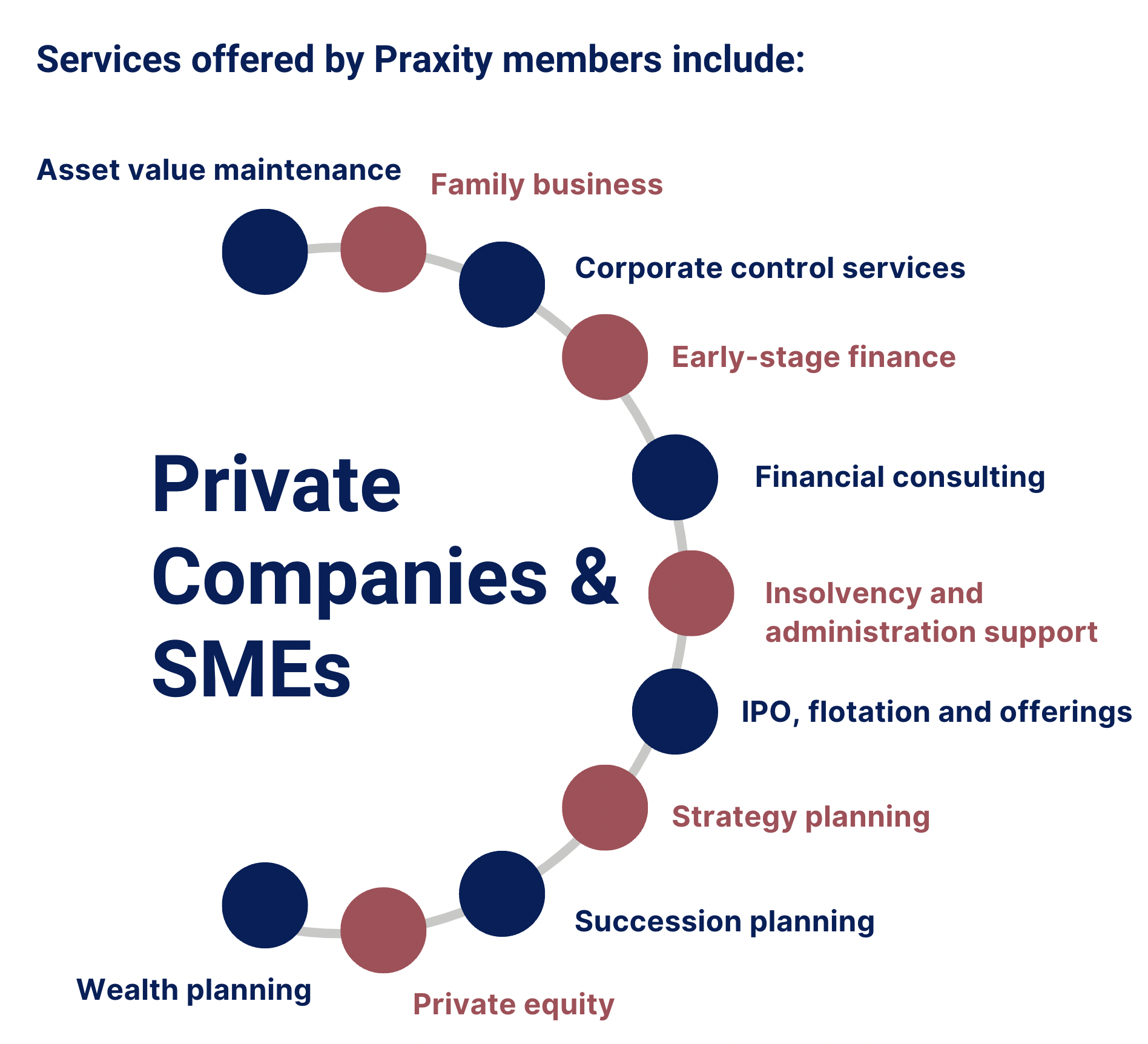

Private Companies & SMEs

![]()

Owing to the market position and connectedness of Praxity Alliance members, they are well placed to help their small to mid-market clients. By offering insight from their own experience, as well as by sharing expertise with like-minded Alliance firms across the world, their deep expertise transcends international borders.

They can help with the distinctive challenges faced by SMEs across the globe – economic uncertainty, rising costs, difficulties accessing finance, keeping up with new technology and compliance, as examples.

They can help calculate the true economic value of enterprises – whether its tangible and intangible assets or intellectual property. Sound and often highly specialist industry knowledge helps clients make their business more successful and valuable.

Member firms can develop financial strategies that generate the capital required to grow smaller private or family businesses. Members can help advise on fundraising for new ventures, assist with mergers, acquisitions, restructuring or disposal.

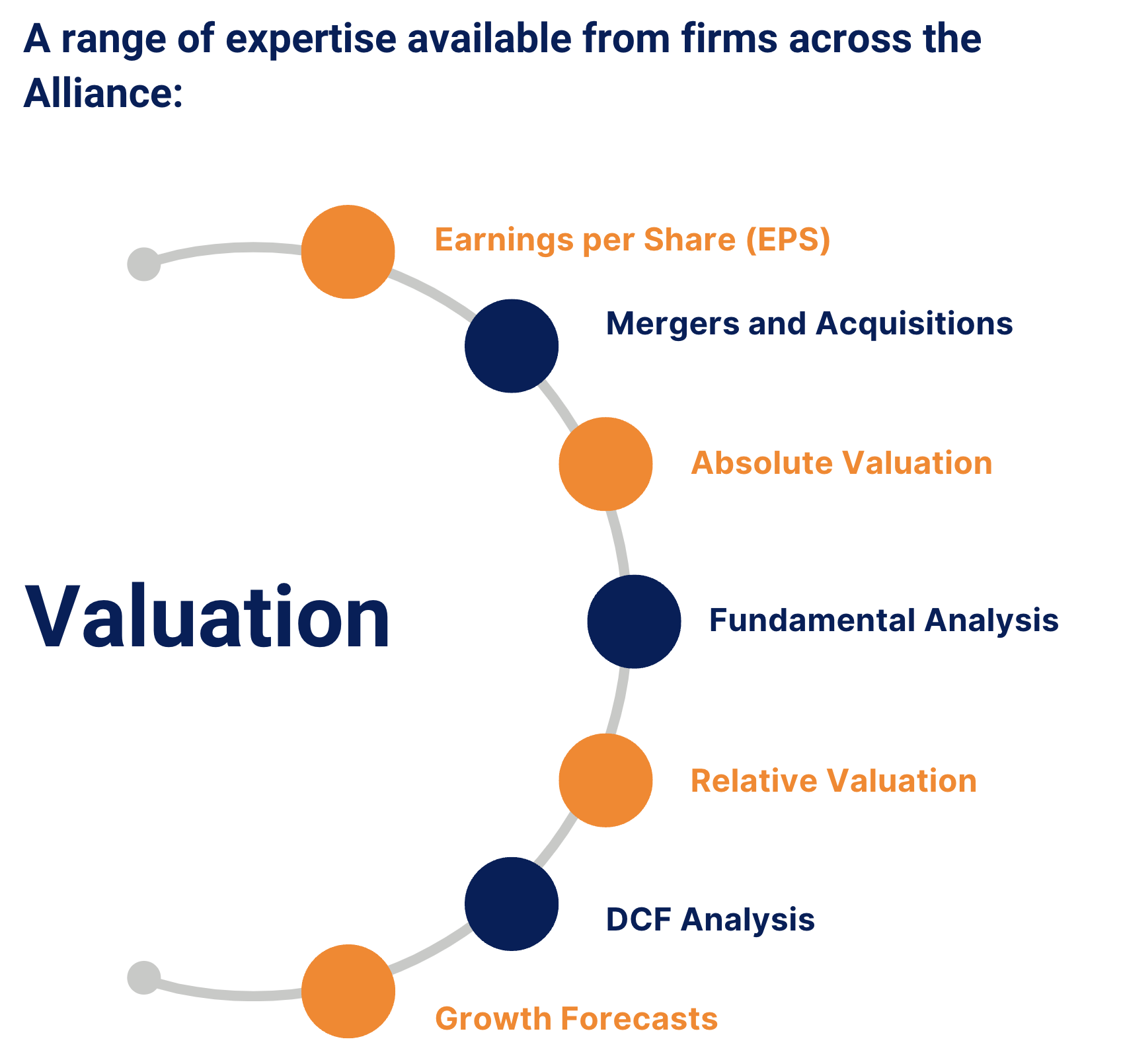

Valuation

Assessing the value of an asset or entity can be a complex process. With many different methods of analysis and several possible routes, Praxity member firms can guide you and your entity through these challenges.

Whether a client is looking to sell existing assets, acquire new ones or is simply taking a comprehensive review, there are experts that can help at every stage and for any size of business.

ESG

![]()

A business area of great growth and change, Environmental, Social and Governance will only become more relevant in the future. Regulation is requiring more from companies on reporting and transparency in the ESG space and Praxity members are well place to help.

ESG allows a business entity to assess its impact on the world around it and allows it to communicate to stakeholders and investors about subsequent actions. This weighs up the quality of firm leadership as well as the credibility of senior leaders to follow through on promises.

ESG accounting considers a firm’s ESG measures as part of business direction, protecting against future shocks and managing risk, ultimately creating positive impacts on supply chains, the environment and the workplace. In many jurisdictions, investors increasingly put their money in businesses with robust ESG measures.